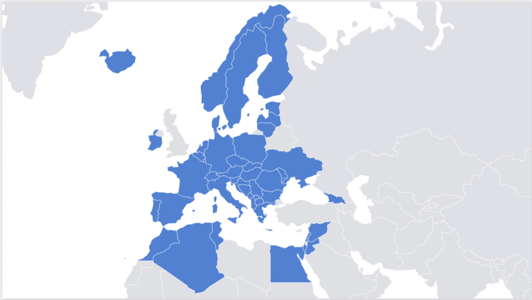

Last December, the European Commission announced that the Pan-Euro-Mediterranean (PEM) Joint Committee adopted new and modernised rules of origin between the EU and the neighbouring PEM countries in an effort to bolster regional trade.

The PEM rules of origin are based on a network of Free Trade Agreements having identical origin protocols. This myriad of 60 bilateral origin protocols is now being replaced by a reference to a single set of rules under a Regional Convention on Pan-Euro-Mediterranean preferential rules of origin (PEM Convention). On 7 December 2023, the Joint Committee of the PEM Convention adopted a new set of rules of origin applicable as of 1 January 2025. After over 10 years of negotiations, 24 PEM trading partners will be able to fully benefit from modernised preferential trade arrangements.

For the EU, but also for the other trading partners, this development is of great importance. In 2022, the EU traded over €700 billion with these countries, which is over half of the preferential trade of the EU.

Most of the rules may ring a bell, as they are currently applied as the PEM transitional rules of origin, which are applicable on a bilateral basis between the signatory countries of the PEM Convention.

Within the renegotiated agreement, four topics and one commitment stand out.

- Simplified product-specific rules,

- increased tolerance rule,

- introduction of full cumulation,

- possibility of duty drawback,

and a commitment to put effort into the development of a system to use electronic certificates of origin.

The implications of these four topics and the commitment made by the PEM Joint Committee will be discussed in the rest of this blog.

1. Simplified product-specific rules

To provide economic operators with an easier way of using non-originating materials in determining preferential origin, certain product-specific rules of origin have been simplified. Furthermore, it was decided to align certain rules to current practices used by economic operators.

One of the rules that has become more lenient is the sufficient working or processing rule based on valuation criteria. With the new rule, the exporter will be allowed to calculate the ex-works price and the value of the non-originating materials on an average basis, which considers fluctuations in costs and currency rates. This average ex-works price and average value of the non-originating materials shall be calculated based on the sum of the ex-works prices charged for all sales of the same products carried out during the preceding fiscal year and the sum of the value of all the non-originating materials used in the manufacture of the same products over the preceding fiscal year.

For example, a manufacturer of calendars, under tariff heading 49.10, needs to make sure that the value of non-originating materials does not exceed 50% of the ex-works price.

In the example below, three shipments took place over one fiscal year. The goods in each shipment had three different ex-works values. Under the old PEM rules of origin, for every batch of calendars sold, the manufacturer needed to be aware of the exact ex-works price and use this value for the preference calculation. The new PEM rules of origin have more flexibility, allowing for an average value to be taken. This would mean that, when looking at the supply chain of for instance the production of calendars. When there are three different ex-works values, it could be that only two out of three shipments qualify for a preferential rate, because each production run/shipment is separately calculated. When taking a average ex-works price, it could be that all shipments of materials qualify for a preferential rate. This also works the same on the sales side.

In practice, this can be useful for exporters and economic operators because they no longer need to calculate the origin for each single shipment; rather, they can adjust it on a regular (yearly) basis for that specific product for more predictable origin calculation. Customs authorities need to authorise the use of this yearly average basis calculation.

2. Tolerance rule

The allowance thresholds for non-originating materials, better known as the tolerance rule, will be increased from 10% to 15%, allowing economic operators to include more non-originating materials in their production process and still be able to claim preferential origin on their goods. This applies to almost all goods, apart from textiles and textile products, where different rules are still applicable, and most food products, which are subject to a weight rule.

For instance, if you produce pens, under tariff heading 96.08, up to 15% of the ex-works value of the finished product may be non-originating materials.

Increasing this tolerance value gives economic operators more flexibility, allowing them to use a larger value or amount of non-originating materials in their production process.

3. Full Cumulation

The topic of cumulation can be challenging within origin management. For an extended period, only diagonal cumulation was allowed in the PEM Convention, and full cumulation only on a bilateral basis. Now, with the new rules, full cumulation is allowed for all products, apart from textiles and textile products, for which it is only valid on a bilateral basis.

Whereas bilateral and diagonal cumulations in the current situation only apply to originating materials, full cumulation applies to working and processing of non-originating materials.

For origin purposes, the PEM zone is regarded as one territory. Full cumulation means that all operations carried out in the PEM zone are taken into account when assessing the final origin. It does not require that the goods be originating in one of the PEM partner countries before being exported for further working or processing in other PEM partner countries, but it does require that all the working or processing necessary to confer origin is carried out on the product within the PEM zone.

Let’s try to illustrate it with an example, where we assume that for any goods originating from the EFTA/EEA, 50% of the ex-works price of the goods can be non-originating. A Norwegian company imports non-originating car parts from the United States worth 80 euros and processes them in such a way that the new value is 100 euros. The value of the non-originating input is 80% of the ex-works price, meaning that it would not qualify for the rules of origin to obtain a preferential rate when importing the goods from Norway into the EU.

Instead of exporting it to the EU, the Norwegian company exports the goods to Switzerland, which is also an EFTA member state.

Some more work is done on the processed car parts, doubling their value to 200 euros. Now, the non-originating input of 80 euros is only worth 40% of the ex-works price. Because the non-originating materials from the United States are less than 50% of the ex-works price, the car parts qualify for a preferential rate when being imported into the EU from an EFTA member state.

This gives traders in the PEM countries the possibility to source their materials within the PEM zone and, depending on whether the materials have been sufficiently processed or whether the added value is larger, the product can be considered as originating from the country in which it has been imported.

4. Duty Drawback

As a final topic within the changes, duty drawback has become available for all commodities except for textiles and textile articles. A brief reminder, duty drawback allows exporters to claim a refund or a waiver on customs duties paid on imported goods that have either been used or incorporated in products for export. In practice, this means that goods produced under Inward Processing by the exporter also may qualify for preferential treatment in the importing PEM party. In the existing agreements, this combination of duty drawback and preferential treatment is, in most cases, prohibited.

An example might be that you import EU bike tyres that are subject to customs duties. When you incorporate these bike tyres into a finished bike under Inward Processing and you export this bike from the EU to a customer in a PEM Convention country, you can save customs duties on the bike tyres in the EU and still have the customer in one of the PEM countries benefit from preferential treatment.

Commitment to the issuance of electronic certificates of origin

A last point is to allow the issuance and usage of electronic certificates of origin by committing to the development of a new system that is capable of handling them. Up until now, traders could make use of the paper versions of the certificates or an approved exporter status. The invoice statements coming from the approved exporter status were not always accepted by every member state, forcing the exporter to issue EUR.1 paper movement certificates. However, during the COVID-19 crisis, the PEM Joint Committee faced a problem with the receipt of paper certificates and proposed to use electronic ones instead. Therefore, they were allowed to use the flexibility set in the agreement for the usage of electronic certificates of origin.

Now, a couple of years later, the PEM Joint Committee proposed to standardise the use of electronic certificates of origin and ensure that every signatory state can exchange and validate the information in an electronic manner. Making the use of electronic certificates of origin is a standard instead of an exception, facilitating trade and making it simpler to provide either of the two documents to prove the status of the goods.

Conclusion

Overall, the more lenient the preference-determining rules of origin, the more trade between partners in the zone is stimulated. This will eventually be beneficial for economic operators active in the area, allowing for a lower bottom-line cost when incorporating materials from suppliers in the PEM zone.

Do you have questions about how the PEM agreement or other free trade agreements and their related rules of origin can positively affect your international trade operations? Contact us for an assessment of your trade lanes.

Leave a Comment